iowa property tax calculator

If you know the amount of Transfer Tax Paid and want to. SimplyDesMoines Iowa TaxPro Calculator Iowa Tax Proration Calculator Todays date.

Property Tax Comparison By State For Cross State Businesses

Annual property tax amount.

. This calculation is based on 160 per thousand and the first 50000 is exempt. How are property taxes determined. The median property tax in Iowa is 156900 per year for a home worth the median value of 12200000.

Iowa Tax Proration Calculator Todays date. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. Our Iowa Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar.

This Calculation is based on 160 per thousand and the. For comparison the median home value in Dubuque County is. Property Tax Calculator Type your numeric value in the appropriate boxes then click anywhere outside that box for the Annual Gross Total to appear.

Total Amount Paid Rounded Up to. The assessor or the Iowa Department of Revenue. A typical homeowner in Story County pays 2783 in property taxes annually.

- Enter amount paid in the box below exclude commas and dollar signs then click submit. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. In part that is a result of high home values as the median home value currently sits at 180400.

Since the closing date is on February 1 the current taxes due are 500 and the prorated taxes for the current fiscal year are calculated from July 1 through January 31 subtracting the. The below schedule addresses household income qualifications for 2022 property tax credit claims for claimants 70 and older. Tax Calculator Font Size.

Real Estate Transfer Tax Calculator You may calculate real estate transfer tax by entering the total amount paid for the property. 2 Tax levy is per thousand dollars of value. October 14 2022 Annual property tax amount Estimated closing date Property tax proration.

1 2018 State of Iowa Rollback - Residential Class - gross taxable value is rounded to the nearest 10. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. Tax Calculator Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present This calculation is based on 160 per thousand and the first 500 is exempt.

The value of property is established. Most property is taxed by more than one taxing authority. The schedule changes each year.

January 1 2021 Assessed Value. So if you pay 2000 in Iowa state taxes and your school district. Counties in Iowa collect an average of 129 of a propertys assesed fair market.

Iowa Legislature Factbook Map Of The Week

Tax Facts For People With Disabilities Iowa Compass

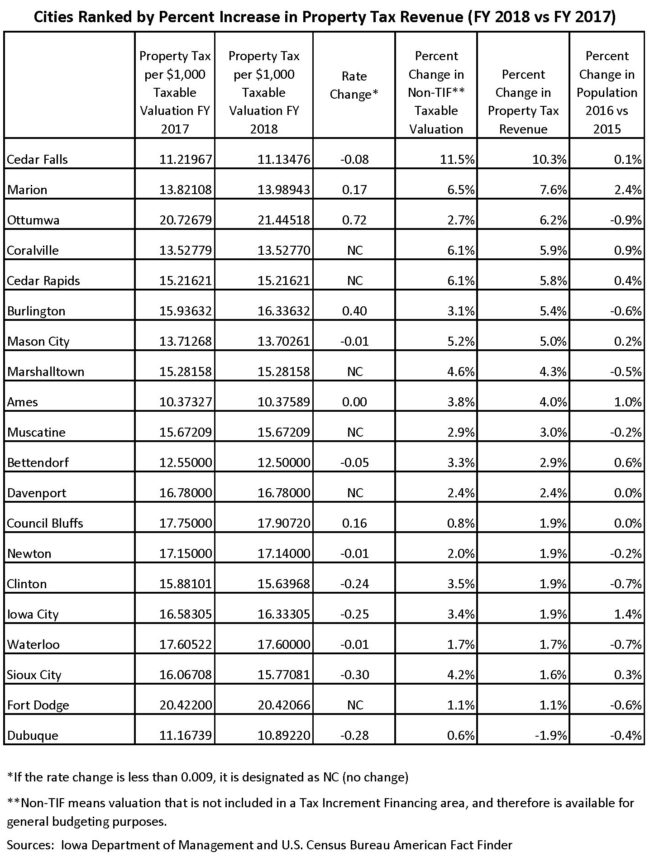

Local Property Tax Revenue Varies Greatly Across The State Iowans For Tax Relief

Does An Iowa School Property Tax Rate School Property Taxes No Mary Murphy

City Of Gilbert Iowa Notice Of Public Hearing For Proposed Property Tax Levy Meeting Will Be Held February 10th At 6 00 Pm At City Hall Facebook

Iowa Or Ia State 2021 Income Taxes Can Be Filed With Irs Return

States With The Highest And Lowest Property Taxes Property Tax Tax States

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

General Sales Taxes And Gross Receipts Taxes Urban Institute

Frequently Asked Questions For The Iowa State Association Of County Auditors

Iowa Property Tax Calculator Smartasset

How Des Moines Area Property Taxes Compare After Rising Home Values

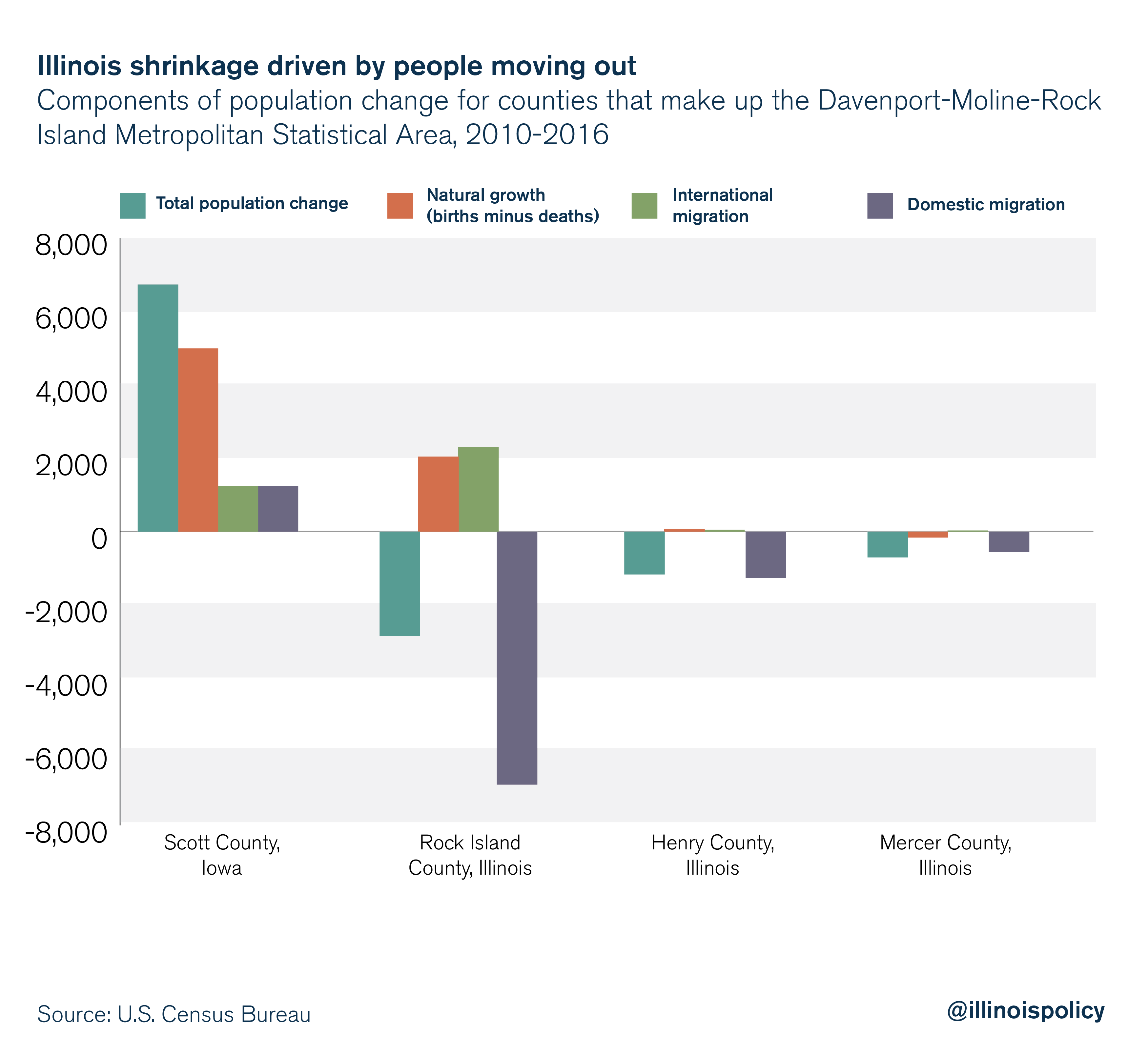

Report Rock Island County Property Tax Rate More Than Double The National Average

Tarrant County Tx Property Tax Calculator Smartasset

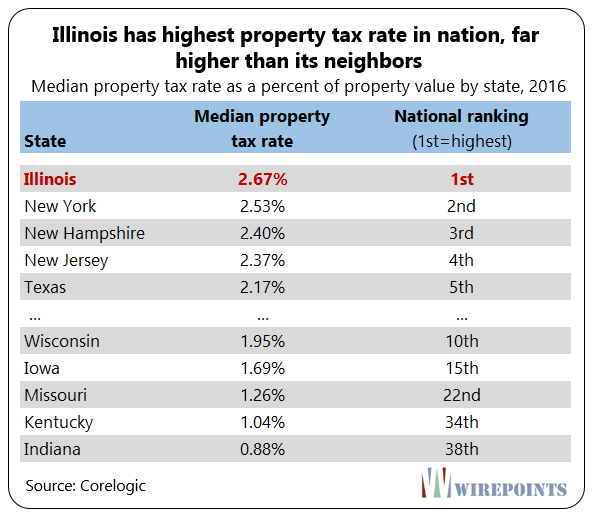

Three Chicago Fed Economists Say They Know How To Tax Fleeing Illinoisans Wirepoints

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax