inherited annuity tax rate

Ad Compare The Tax Benefits For Many Annuity Types And Find The Right One For You. Ad Learn More about How Annuities Work from Fidelity.

Annuity Beneficiaries Inherited Annuities Death

The rates for Pennsylvania inheritance tax are as follows.

. Inheritance Taxes on Annuity Benefits Pre-tax dollars are used to fund qualifying annuities. Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium. The money paid into this type of annuity grows on a tax.

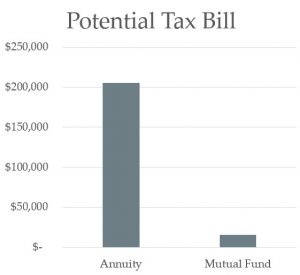

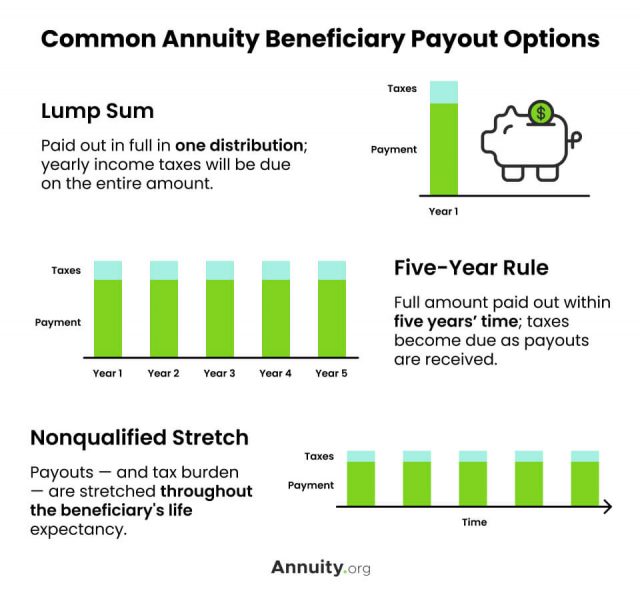

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket. If youre younger than 59 ½ and anticipate that youll need to use the inherited annuity to cover living expenses or medical costs dont take over the annuity just yet.

Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios. If the annuity was an IRA annuity the SECURE Act that went into effect on January 1 2020 stipulates that if you inherit an IRA youll now generally have 10 years after the account holders.

A split-annuity is a method of utilizing two annuities at the same time rather than using one product. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios. Ad Learn More about How Annuities Work from Fidelity.

The original annuity contract holder must include a death benefit provision and name a beneficiary. Because the owner never paid any taxes on the. 4 hours agoRetirees turn to annuities for an immediate or future stream of guaranteed income in exchange for a lump sum or periodic payments to an insurer.

Annuities are taxed at the time of withdrawal regardless of the. Non-qualified annuities have a similar tax treatment to some other types of retirement-focused investments. Fisher Investments warns retirees about annuities.

Is an inherited annuity taxed as ordinary income. The money invested in an. How to figure tax on inherited annuity.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Inherited annuity payouts may follow different tax rules.

Just like any other qualified account such as a 401 k or an individual. The goal of this strategy is to let an investor use existing funds to create income for a. If the beneficiary is a spouse of the deceased annuitant they can carry on with.

In turn taxation of annuity distributions. 45 percent on transfers to direct. Inherited annuities come with a number of tax implications especially if the inherited beneficiary is a non-spouse.

Fisher Investments warns retirees about annuities. Were transparent about how we are able to bring quality content competitive rates and useful tools to you by explaining how we make money.

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

Finding Your Tax Equilibrium Rate When Liquidating Retirement Accounts Paying Taxes Retirement Tax Brackets

2021 Investment Outlook Investing Financial Coach Economic Trends

Inherited Annuity Tax Guide For Beneficiaries

Period Certain Annuity What It Is Benefits And Drawbacks

Understanding Annuities And Taxes Mistakes People Make Due

Ever Wondered How Much Financial Advice Cost Then Take A Look At Our Cost Of Financial Advice Menu Financial Advice Financial Advisors Financial

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Annuity Taxation How Various Annuities Are Taxed

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Tax Troubles With Annuities Ann Arbor Investment Management Vintage Financial Services

Annuities 11 Solutions To Enhance Your Retirement In 2021 Annuity Life Annuity Lifetime Income

Annuity Beneficiaries Inheriting An Annuity After Death

Annuities 11 Solutions To Enhance Your Retirement In 2021 Annuity Life Annuity Lifetime Income

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Fidelity Guaranty Life Safe Income Plus Annuity Review Annuity Income Activities Of Daily Living